Only tuition costs and fees are qualified additional activity fees are not Not qualified, even for a health plan provided by the student’s school Often a concern for out-of-state studentsĮven if for travel to and from campus during holiday times, no travel costs qualify

#529 qualified expenses software#

Software should be predominantly educational in nature Must be used primarily by the 529 beneficiary and during years of enrollment Must be enrolled at least half-time (credit hours defined by school)įor off-campus housing, contact school’s financial aid office for applicable cost of attendance amountsĬomputers, computer hardware, software, and internet access Maximum amount is greater of either 1) actual charge for residence in school-operated housing or 2) annual “financial aid cost of attendance” room and board amount for that school Must show connection to enrollment or attendance Keep evidence of requirement (e.g., course syllabus) Items may be purchased from anywhere (e.g., Amazon)

K–12 eligible (eligibility varies by state) Department of Education’s student aid program

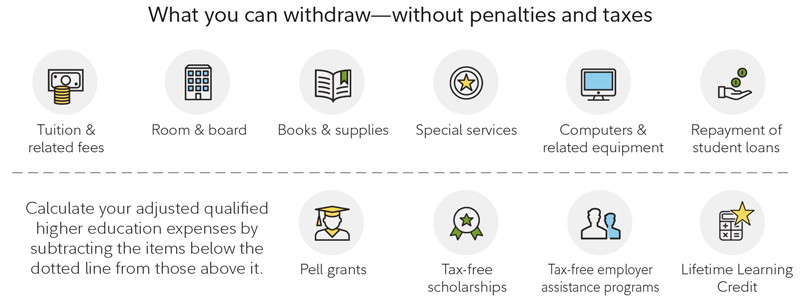

Qualified ExpensesĬollege must be accredited and eligible for U.S. The charts below provide an overview of some of the most common qualified and non-qualified expenses. But before you begin withdrawing those funds, it’s important to understand the difference between qualified and nonqualified expenses. You’ve put in the hard work of saving for college, and now it’s time to start using those 529 plan assets to help with a family member’s education-related costs.

0 kommentar(er)

0 kommentar(er)